Bitcoin Vs Real Estate

As we witness Bitcoin’s meteoric rise, it's impossible to overlook the potential shift in the financial landscape. Traditional assets, long considered the bedrock of wealth, may no longer hold their dominant position. Could the digital age be ushering in a new era where Bitcoin not only serves as a store of wealth but outperforms established assets like real estate, which has historically been the cornerstone of investment portfolios? The rise of Bitcoin suggests that we may be on the brink of a major transformation in how we view and accumulate wealth. Let’s look at how Real estate stacks against Bitcoin:

Real Estate

Tangible asset with intrinsic value, but doesn't have the same historical high returns as stocks.

High initial costs and ongoing maintenance requirements.

Offers multiple investment opportunities and is a regulated asset.

Can lead to long-term returns.

Bitcoin:

Significantly lower initial investment cost compared to real estate.

No continual maintenance requirements.

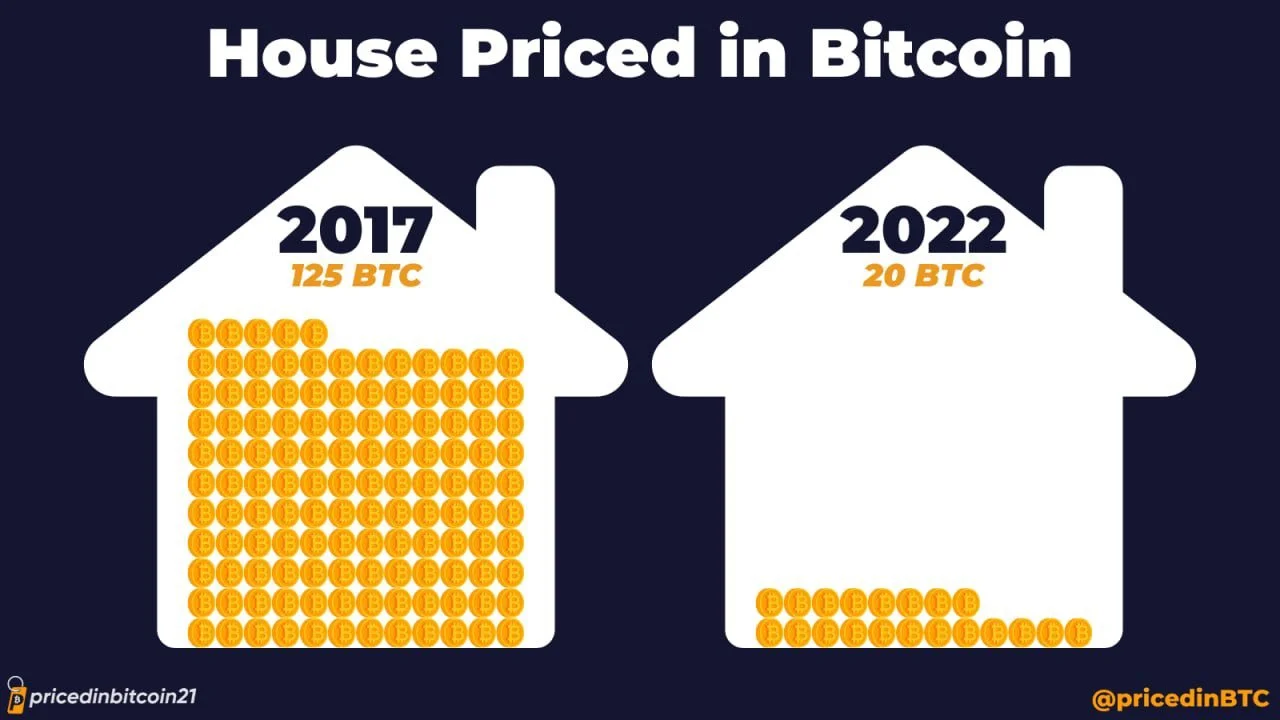

Over the last five years, Bitcoin has outperformed real estate in returns.

Can lead to short-term and long-term returns.